By SEN ROBERT MYERS

In my last article, I spoke about why the Permanent Fund dividend keeps getting cut. But the PFD is not the only problem we have with the Permanent Fund.

The annual draw from the Permanent Fund has become the largest source of revenue the state has, projected to cover 64% of the state’s unrestricted general funds available for spending this coming year. Both the fight over the PFD and the reliance on the Permanent Fund for state spending have put the Fund’s earnings into a spotlight. Some people say that higher returns from the Fund could mean we could pay for government and the PFD without much trouble. That might be true (it would also put on added pressure to spend and further reduce the connection the state has to the economy), but we have a bigger problem.

In order to meet the 5% POMV draw, the funds needs to be earning 5% plus inflation after accounting for management expenses. Over the last seven fiscal years, it’s only done that twice. When compared to a basic passive index fund from the S&P, the Fund could be earning much more. But it’s not getting those returns because the Fund is not managed for maximum returns; it is managed to protect the spending by the state.

Let’s take a look at a couple of charts that illustrate the problem.

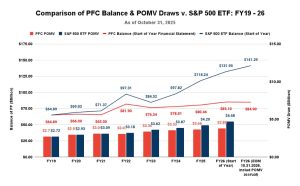

The lines on this first chart show how the earnings of the Permanent Fund (red) compare to what they could have been under the same investment in an S&P 500 index fund (blue). The bars at the bottom show what the annual draw would have been at those levels. Assuming that the state budget had remained the same (it may not have), the PFD would have been about $2284 last year instead of $1000. And that’s just since July of 2018. But of course, hindsight is always 20/20. We shouldn’t blame someone for missing an investment opportunity over a short period of time. Let’s look a little further back.

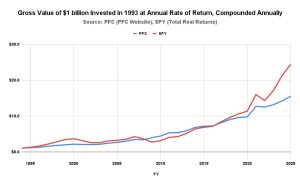

In this chart, we’re looking at what would have happened to a billion dollars invested the same as the Permanent Fund returns (blue) compared to an S&P 500 index fund (red) since 1993. Please note that this chart is strictly based on the investment returns. It doesn’t take into account any payouts (PFDs or government draws) or deposits (yearly royalties from oil). Except for the 2008 financial crisis and a short time thereafter, we would have been better off using the index fund. Please note that this does not take management fees into account either. The Permanent Fund Corporation management fees have a history of being significantly higher than those of an index fund. That would further depress the PFC returns compared to the index fund.

So if the index fund is so much better in the long run, why doesn’t the Permanent Fund Corporation manage it that way? If you ask them, they’ll say it’s because they are trying to avoid volatility. Coming directly from Trustee Paper #10, the board of the PFC writes, “While concerns over the durability of the [Earnings Reserve Account, a portion of the Permanent Fund] are acute at present, the current structure will inevitably produce periodic uncertainty to the sustainable funding of the POMV distribution.” Please notice that they are saying the draw is the priority, not the Fund itself. That only matters if the point is the spending.

The volatility that they are referencing is something you want to avoid if you are using investment returns as your sole or primary source of income for a period of time. So the general rule for a person investing for retirement is to allow for high volatility (and generally higher returns) during working years but then switch to lower volatility (and lower returns) once a person approaches and goes into retirement. But that doesn’t make sense for a fund that will be drawn on every year in perpetuity. There is no event to trigger giving up higher returns for more stability.

So why give up growth that lets us spend more in future years? It is a political decision that makes spending easier for the legislature. For a legislator, especially one with the pressures to spend that ours face, it is never fun to tell someone no when they ask for more money. But there is something worse: telling someone they will get even less money than they got last year. Legislators are deathly afraid of that because voters and interest groups will be frantically looking for another candidate who won’t tell them that. It’s somewhat easy to not grow spending because you don’t have the money, but it’s much harder to cut if revenue drops.

That’s also why we moved from a draw for the dividend based on earnings to a draw for government based on total Fund value. Earnings are much more volatile than total value, even when accounting for the five-year average that both formulas use. The dividend was helpful for individuals, but it was never meant to be something to live on. Volatility didn’t matter so much. But political pressures make it much harder for a government to base spending on an income stream that is so volatile when it dominates all other revenue streams.

This is all fine and dandy for politicians, but the PFC is supposed to be non-political. Their mission is set out in Alaska Statute 37.13.120(a): “…in regard to the permanent disposition of funds, considering preservation of the purchasing power of the fund over time while maximizing the expected total return from both income and the appreciation of capital.” In layman’s terms, the PFC is supposed to be managing the Fund in such a way as to combat inflation while maximizing total value. They should not be saying anything about what is drawn off or how the money is spent. That is completely up to the legislature and the governor.

But going back to Trustee Paper #10, the PFC board says, “Rather, it has been repeatedly shown that a spending rule based on a POMV linked to a portfolio’s long-term average real return – that is returns after accounting for inflation – results in a more stable and predictable spending profile than the traditional, income-only approach.” They are arguing in favor of using the total value to calculate the draw (used in the POMV) instead of the earnings draw (used in the traditional PFD calculation). In other words, the PFD board is speaking on how the funds should be spent, not just on how they should be invested. They are weighing in on the side of stable spending for government.

Combining this with the explicit concern for volatility, it is clear that the PFC is managing the Fund to make the spending as predictable as possible. They are supposed to be managing for the health of the Fund; in fact, they are managing for the health of the spend. They should be managing financial risk. Instead, they are managing political risk.

The one other question I often get about the Permanent Fund is why our Fund is not the size of Norway’s Government Pension Fund Global, often known as the Oil Fund. Norway discovered oil about the same time we did, but they didn’t start their fund until 1990. While our Fund is approaching $90 billion, the Norwegian Fund is currently worth about $2.2 trillion.

Let me quickly outline the differences. The first is income. Alaska makes money from oil in four ways: royalties, production taxes, corporate taxes, and property taxes. We invest 25% of the royalties in the Permanent Fund and spend the rest. That is what allowed us to both raise spending significantly and eliminate the income tax. In contrast, Norway kept its regular taxes and puts every dollar it gets from oil into the Fund. They also are still producing roughly four times as much oil as Alaska.

The other difference is on the spending side. Alaska started paying the PFD from the Permanent Fund in 1982, but Norway didn’t pull any money from its fund until 2016. While we are currently pulling five percent of the value of our Fund, the Norwegians are only using three percent of theirs. And while our Fund draw accounts for 64% of our unrestricted revenue, their Fund draw is only about twenty percent of their government spending.

The real difference is not in the value of the respective funds. The difference is in the resulting changes to government and the economy. They have avoided most of the problems of an oil based economy, keeping significant growth over the period of oil development even as oil is about the same percent of the overall economy as Alaska. But they haven’t lucked out completely.

Compared to their Scandinavian counterparts, they are generally regarded as more corrupt while having lower educational outcomes. Even when the oil money is completely divorced from the government, having oil as a dominant sector of the economy is problematic.

Senator Robert Myers was born in Fairbanks and spent much of his young childhood at the Salchaket Roadhouse, owned by his parents. He attended the University of Alaska Fairbanks, where he studied philosophy, political science, and history. While in college, he drove for a tour company, sharing Alaska with countless visitors. He currently drives truck and travels the Dalton Highway (Haul Road) frequently. He ran for office because he wants an Alaska his children will choose to make their home down the road. When not working for his Senate District B, North Pole, he enjoys reading, history, board games, and spending time with his wife Dawna and his five kids.

Sen. Robert Myers: Why do so many Republican legislators support higher spending?

Sen. Robert Myers: Why do we spend so much money but have such poor quality services?

Sen. Robert Myers: If the Permanent Fund dividend is so important, why do we keep cutting it?

7 thoughts on “Sen. Robert Myers: Why is the Permanent Fund managed for steady spending instead of maximum returns (and why we’re not Norway)?”

Remind again why we should care: (a) what they do in Norway, (b) when a certain Alaskan Senator’s gonna propose a law to fix whatever crisis du jour this is all about, and (c) what a certain Alaskan Senator’s doing to shove Co-Governor & Finance Minister Giessel’s education-industry income tax right back up where it came from.

“………Remind again why we should care: (a) what they do in Norway……….”

Well, because they built two funds like ours soon after we started, but they didn’t waste theirs like we did, and they’re now the richest nation on Earth. Unfortunately, it’s too late for us now, so we’re destined to fight for decades for what will become scraps.

Your comment reminds me of the old Alaskan assertion that “We don’t give a damn how they do it Outside”, and sure enough, they’re selling more oil than we do, too…………….

What you confirm is that a majority of Alaskan politicians and bureaucrats lack intelligence and positive character traits necessary to manage Alaska’s Permanent Fund (and, now you mention it, almost everything else) with Norwegian-like integrity and success

.

Can’t disagree.

.

Alaska declining into bankruptcy, in every sense of the term, may be happening right in front of us, but we don’t give up.

.

Look at it like this: things look dark now, but nothing like the dark that hit Norway when the Nazis invaded and Prince Harald had to flee to America. Now the Nazis are gone, King Harald and the Storting governed Norway into something we want to emulate.

.

Okay, we’ve no monarch, not even Co-Governor and Finance Minister Giessel, peace be unto her. We’ve no unicameral Storting, though Alaska’s two chambers seem more alike than different in their inability to govern Alaska into similar success. What do we do?

.

Can’t give up. Regime as corrupt as Alaska’s has weak points, Figure out how to exploit them, go all Jack and the Beanstalk, decent folk may be able to build their own postwar, American success story.

.

Norway did it, took care of their Quislings too, but Alaska can’t?

Excellent analysis. Spot on.

It should be obvious that the prioritiesOf those making the decisions lie not with providing value to the public,but with maintaining their own power and ability to buy votes, the public’s wants and needs be damned. They feel their needs to Spend!! Supersede the will of the people, because They Know Better how it should be spent.

“Voters and interest groups will be frantically looking for another candidate…” I’m guessing that most of the “pressures to spend” are coming from the interest groups, primarily OUTSIDE interest groups.

Robert, this series of articles has provided a lot of insight into a complicated set of problems. Do you have any ideas for solutions?

The above is a good article for explaining how our Permanent Fund earns less than some other more aggressive funds. But that our Permanent Fund has less worrisome volatility.

The article also is very good at showing differences between Alaska’s Permanent Fund and Norway’s giant oil fund.

I think stability of revenue coming into our government is very important. The article seems a bit less warm to that idea by its term “protect the spending”.

But if oil tax revenues suddenly plummet, like in 2014 and 2015, when world oil prices crashed, it’s a real problem if we have to yank the rug out from essential services. Luckily back in 2015, our state emergency savings account (the CBR) had about $12 billion in it to tide us over. But it’s supposed to be refilled during times of plenty. That has not happened. That crisis also led to the passage of SB-26 (the Permanent Fund POMV Law) in 2018. That allowed for PF earnings to be used for state services. This added needed steadiness to our vital revenue stream.

This excellent article, full of interesting facts, concludes with:

(Norway) is “…regarded as more corrupt…”

And “…having oil as a dominant sector of the economy is problematic.”

Is the article implying that oil is “problematic” for Alaska too?

I think oil here in Alaska is wonderful and a blessing to us. We are the only state that does not have to have state income tax and state sales tax yanked out of our pockets. I am so thankful for that.