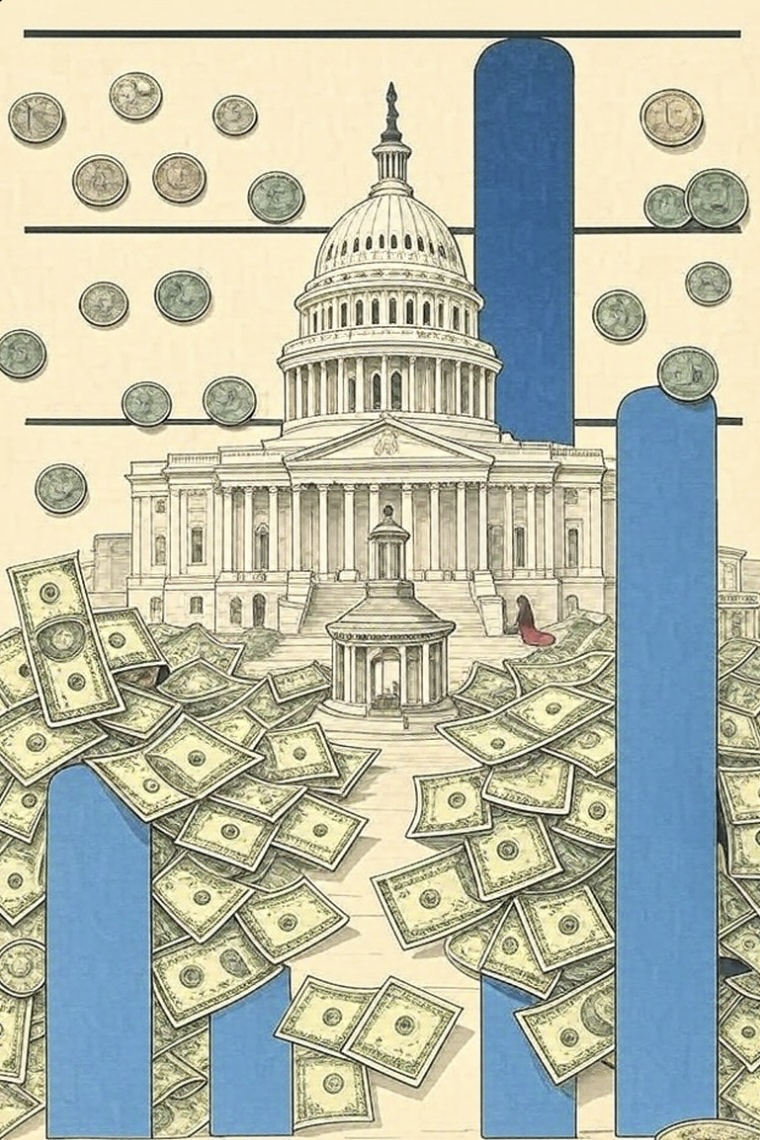

The national debt surpassed $38 trillion on Oct. 21, marking another historic high for America’s finances and signaling a deepening fiscal crisis that continues to divide politicians. According to Treasury Department data, the figure reached $38,019,813,354,700.26.

The milestone came just two months after the debt hit $37 trillion in mid-August, meaning the nation added $1 trillion in only 68 days.

That is the fastest pace of borrowing ever recorded outside the massive stimulus spending of the Covid-19 pandemic and may be understood as an aftershock of that spendathon. On average, the federal debt grew by roughly $14.7 billion per day, or about $1.2 million every minute, far outpacing both population growth and inflation.

The $38 trillion mark was also reached during a partial federal government shutdown from Oct. 18 and continuing through Oct. 28, when lawmakers have failed to reach agreement on spending bills. While the Treasury Department maintained basic borrowing operations through “extraordinary measures,” the political stalemate stalled discussions over long-term fiscal reform and the debt ceiling.

For the first time in US history, annual interest payments on the national debt now exceed defense spending. Net interest costs hit an estimated $1.1 trillion for fiscal year 2025, compared to about $900 billion for the Pentagon. That makes interest now the largest single line item in the federal budget, consuming an ever-greater share of tax revenues and squeezing discretionary programs.

At $38 trillion, the per-capita share of the debt stands at roughly $113,000 for every American, or about $452,000 for a family of four, a reminder of how the debt burden extends to future generations.

The financial milestone has intensified partisan bickering on Capitol Hill. Republicans blame the debt surge on unchecked spending, while Democrats criticize tax cuts and defense increases as the main drivers.

The crossing of the $38 trillion threshold carries weight during this 250th anniversary of American independence. The Congressional Budget Office now estimates the debt-to-GDP ratio at about 126%, the highest since World War II, in sharp contrast to the fiscal restraint that defined the early years of the Republic.

6 thoughts on “National debt surpasses $38 trillion”

Thanks conservative hypocrites!

Almost makes me hope I die before the bill comes due 💵💰💸💸💸

Ditto. But then there are the kids. – sd

Certainly, we should be experiencing some savings due to the Fed Guv’ment being shutdown for the last 29-days!?!? And, we seem to be getting along just fine with little to no impact. Hopefully, this effort will demonstrate what Agencies we can literally do without and effectively eliminate them.

You would think! – sd

It is a disgrace. I do not think either political party or the majority of the electorate has the political will to course correct. I had high hopes this winter, but little was done to rein in the 2 trillion deficit. We will go bankrupt. It is just a matter of time, as no amount of growth will cover the ever expanding interest payment that now totals more then defense allocations per annum. Pray.