By SUZANNE DOWNING

Feb. 16, 2026 – The governor’s fiscal package was shredded Monday in the Senate Resources Committee, where majority-control lawmakers stripped out his proposed statewide sales tax and replaced it with a new income-based “education head tax,” while layering in several long-sought oil and corporate tax changes.

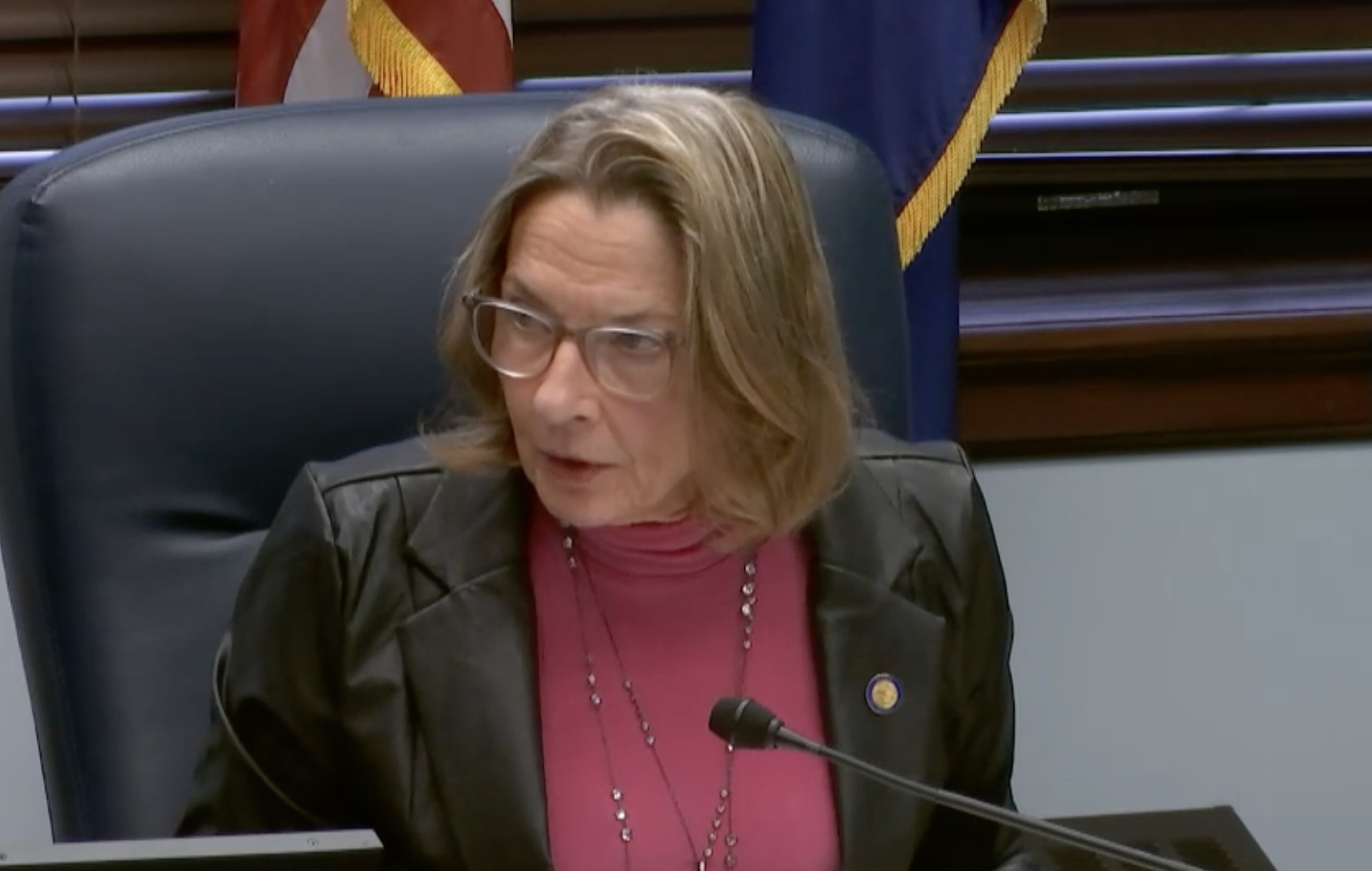

The bill, SB 227, the Gov. Mike Dunleavy fiscal restructuring of the state revenue picture, had a provision that required all parts to pass together. Sen. Cathy Giessel removed the governor’s conditional “all-or-nothing” clause, meaning the remaining tax provisions could now take effect even if other components fail later in the process.

Among the most significant changes is the complete elimination of the sales tax proposal, which had been pitched as a way to broaden the state’s revenue base without directly taxing wages. In its place, the committee inserted what is called an education head tax, a per-worker charge tied to annual income.

The new Section 13 establishes the head tax on wages and self-employment earnings, with revenues intended for education and deferred maintenance of public buildings.

Under the committee substitute, the tax would be collected through employers, who would be required to withhold half of the estimated amount unless the employee can demonstrate the tax has already been paid for the year. The brackets are small in dollar amount but explicitly linked to income:

-

Individuals earning $30,000 or less would pay $10 annually

-

Those earning between $90,000 and $150,000 would pay $20

-

Those earning more than $150,000 would pay $30

The “income tax Trojan horse” is a statutory foothold for future expansion.

Sen. Giessel defended the approach as a way to ensure that “everyone takes part in supporting the state,” while emphasizing that the head tax is not constitutionally dedicated, but instead reflects legislative intent for education and maintenance.

The committee also added a series of corporate and oil tax provisions that is a full menu of tax increases.

Section 12 changes Alaska’s corporate income tax rules by adopting market-based sourcing for highly digitized businesses, a change designed to capture taxable income from companies that operate extensively online. This is Sen. Rob Yundt’s controversial tax.

In Section 3, lawmakers inserted SB 92, a measure often referred to as the “Hilcorp tax” because it primarily affects one large producer. But not anymore: The provision lowers the taxable income threshold for certain corporate taxpayers, reducing the bracket trigger from $10 million down to $1 million in net income. While Hilcorp is frequently cited, other S-corporations in Alaska, including smaller operators, would be impacted.

Several oil tax changes were also folded into the bill. Section 14 establishes a 6% minimum oil tax floor, preventing the production tax from dropping below that level under any circumstances.

Sections 17 through 25 incorporate SB 112, which adjusts the per-barrel credit on a sliding scale, reducing it from $8 down to $5 depending on oil prices.

And in Sections 27 and 28, lawmakers retained the existing $15-per-barrel surcharge, removed its sunset clause, and set a new effective date of Jan. 1, 2027.

The effective date for the S-corporations, however, is retroactive to Jan. 1 2026, creating an unexpected tax surprise.

Giessel also pointed to legislative intent language tied to infrastructure, noting that the 15-cent-per-barrel component is meant to support maintenance of the Dalton Highway, though it is not formally dedicated.

The education head tax proposal comes as lawmakers across both chambers search for new school funding mechanisms. A separate bill by Rep. Rebecca Himschoot, House Bill 152, proposes a much larger flat $150 education head tax on wage earners, residents and nonresidents alike, to generate revenue for public schools. The Senate version, by contrast, uses a sliding scale and far smaller annual amounts — for now.

With the Senate Resources rewrite, the governor’s original fiscal framework has been decimated.

8 thoughts on “Breaking: Senate committee shreds Dunleavy fiscal plan, swaps sales tax for income-based ‘education head tax’”

If parents are dumb enough to keep their kids in public schools, then let them pay the tax. If parents have pulled their kids from the failed public school system, and have them in an alternate method of education, such as private/religious schools, they should not have to pay a dime to support public schools (though they already do indirectly).

The adults are in the room. A much more serious approach than what was originally presented.

They can take my taxes out of my PFD they stole…..

The cost of the infrastructure to administer the collection and dispensation of the new tax will outweigh any benefit.

And the problem with the education system is not a lack of cash: it’s the lack of accountability. They should be looking to raise grades, not spending…

Do away with the PFD (which more than kills the deficit), fund the governor’s budget request fully, deposit the leftover PF earnings back into the corpus, and leave Juneau early, thereby saving another huge boatload of money.

What i want to know is what are they doing with all the pot revenue? Where is it , how much is there, and why are we not using that to directly fund schools and social programs???

Leaving Alaska there is no end in site. Going to a state where I know how much I will be taxed. Already paying the education system with high real-estate tax and we don’t have kids in school here !!!

EAT CRAP and choke on it, you can stuff your taxes up your A%% > nothing but political prostitutes in the capitol in Alaska, once RANK Choice is removed, you asswipes will no longer be able to rig the elections. You’re going to reap what you have sown.