By MARGARET NELSON

Feb. 6, 2026 – The deadline to appeal your Municipality of Anchorage property tax assessed valuation that hit homeowners last month is Feb. 11. Many Anchorage homeowners are reporting valuation hikes of 25 to 50%, and some even more.

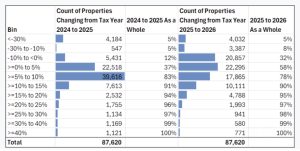

The Anchorage assessor’s office reported that it completely revamped the Muni’s assessment methodology in 2025 to more accurately reflect “fair market value.” The average increase was 4.3%, the Muni reported on its website. The majority of properties (58%) changed by less than 5%.

Approximately one-third of properties (32%) saw valuation decreases. But some properties did see large adjustments; 10% of properties were adjusted by more than 10%.

More than 20,000 households saw an increase of 10 percent or more.

The biggest justification of the increase comes from two areas:

The first is a cost model that significantly increased the base value of homes in the Muni, and the “guesses” as to valuations of homes, given the lack of reported sales. Alaska is a non-disclosure state so the Muni relies on homeowners to send in sales data when they buy a home.

The Cost Model uses as a significant input a “base value,” which was trued up using the best-available cost data, the Muni said. [Long ago, the Municipality adopted a base value of $93,950 which had been several times adjusted, until by 2025 the adjustment factor was 2.4133—suggesting we were overdue for a true-up. For 2026, the department used new data from Marshall and Swift (the leading vendor, https://www.cotality.

Second, in the report we can see that the Muni assessor admitted that there’s not enough sales in the Anchorage area to accurately reflect market values.

“For comparative sales, the department adopted more defensible “market areas,” after consulting with a certified assessment evaluator who advised on best practices and standards from the International Association of Assessing Officers (IAAO). The update replaced what, over time, had become an “obsolete neighborhood structure, which consisted of 430 neighborhoods in 27 groups” that was becoming increasingly difficult to administer because “with a decreasing number of reported annual sales, most neighborhoods had insufficient data to develop supportable market adjustments.”

Finally, the assessor did look at neighborhoods. However, there’s no supporting documentation (other than assembly districts which are very large) to determine how the assessments were in smaller areas of the Muni, i.e. Hiland Road versus downtown Eagle River, or Turnagain versus Sand Lake.

The Muni reported that it is looking at four neighborhoods that experienced high increases: Goldenview Park, Sahalee, Lookout Landing, and Leary Bay. The Muni said properties in these neighborhoods warrant the issuance of revised valuation notices. About 660 homes will receive new, lower, assessments because of this proactive review, the Muni said. This is less than 1% of the total assessed properties in Anchorage.

To appeal the valuation, homeowners have two options:

1. Contact the assessor’s office for an informal appeal

2. Complete a formal appeal.

The assessor’s office is working with property owners who call 907-343-6500 to complete informal reviews of properties. There is no fee for the informal process. At the mayor’s direction, the assessor’s office is also proactively looking at areas of the municipality that saw significant valuation increases and determining whether the incoming calls are surfacing an underlying pattern.

Some homeowners are reporting that it appears that conservative districts saw higher increases than others. Those homeowners who have called have not yet reported adjustments. It could be that there’s a backlog of phone calls given the number of homeowners who saw large increases.

The longer process is to formally appeal by filling out an application and submitting a refundable deposit, usually about $200, but it could be as high as $1,000. Some real estate licensees are providing market analysis of homes to determine fair market value to assist homeowners with this appeal. This is a recommended first step. Homeowners may find that they properties are worth more than they expected, and the appeal would not be justified if that’s the case. Also, there is a risk in the formal appeal that Muni may require a home visit, which may result in a higher assessment. Consult your real estate professional for their opinion and/or market analysis. Many will provide a market analysis for free or a small fee.

Anchorage Assembly members Jared Goecker, Keith McCormick and Scott Myers on Tuesday introduced a resolution asking the assessor to review any property assessments that increased more than 8% and treat any that increased more than 20% with a presumption of error. The assembly approved the ordinance.

Margaret Nelson is a real estate broker with Denali Real Estate headquartered in Anchorage.

5 thoughts on “Margaret Nelson: The deadline to appeal your Anchorage property tax assessed value approaches. Here’s what you need to know”

I’ve been through the Informal process. The gentleman was very prompt in replying but, stuck to “recent sales” (a neighbor) that jacked up my assessment by over $100K. The house on the other side of the sale also went up by the same amount. My neighbor to my other side saw his home jacked up by over $73K – and those are only the ones that I know well enough to ask. When I provided the Assessor with numbers from their own site, he stood by his previous answer and that he didn’t feel that I had adequate evidence to win a formal appeal. Note: we have 3 beds, 3 baths and a 200sf smaller home than the 4 bed, 4 bath home that sold. Our lot is smaller and our home is 1 year older as well. That made NO difference. It appears that the inflated, unrealistic market and the MOA’s lust for more money while ignoring spending is driving up the property values and our property taxes.

So the Mayor directed the assessor to looking at areas of the municipality that saw significant valuation increases.

.

The Charter, “Article XIV, Taxation, Section 14.01, Taxing authority” says “The taxing power of the municipality is vested solely in the assembly. The taxing power may –not– be surrendered, delegated, suspended or contracted away except as provided by law (emphasis added).

.

Is it reasonable to conclude: (a) the Mayor’s order intentionally violates the Charter by inserting Mayoral authority in the taxation process, and (b) the real-estate industry condones the violation because it sustains the symbiotic relationship between MOA’s inflated assessments and industry’s inflated appraisals?

.

Symbiotic? Aren’t the real-estate industry and the muni so conjoined that one can’t live without the other, but both can live and prosper if they feed each other?

.

Why violate the Charter, why condone the violation? Could they be fine-tuning their emergency response to Eaglexiters leaving and taking their property tax money with them?

.

Could the Assembly just not care about the Charter violation because they know they’ll get their money one way or the other, that’s all that matters to them, so the Mayor can be the designated scapegoat?

.

Fine tuning? Sure and what politician in his right mind wants to annoy the Goldenview Homeowners Association or the Afghan Hill tribe, you know, the high-rent district just east of South Goldenview where they fly the Afghan flag but not the American flag, where they live in really big houses, and actually have no bums infesting their sidewalks?

.

Just stiff renters, commercial property owners, and average working stiffs, they won’t hit back, they got to live and work here, and for some it’s a tax write-off anyway, right? Besides, never mind the Fourth Amendment, the “Muni may require a home visit, which may result in a higher assessment”, and what working stiff’s gonna bet on that lame horse?

.

You may mean well, Margaret, but the optics are really bad.

.

Good news is we didn’t expect anything different …or better.

I am still waiting for a callback from the Assessor’s Office on my request for an informal appeal. The recording stated it may be two days before I receive a return call and I am on day two now. I heard talk at the Assembly Meeting about them possibly extending the deadline for filing appeals from Febraury 11th to March 11th but I have not seen that in writing anywhere.

Nancy… Use the email that their voicemail provides: propappcs@muni.org

Not that you’ll the answer you’re hoping for.

Note that this is the second year in a row LaFrance’s Muni has done this. It started with the 2025 assessment. We up up 30% over the last two years. None of it justified other than LaFrance and her peeps on the Assembly wanting more money. Cheers –