By REP. KEVIN MCCABE

Jan. 23, 2026 – The legislature is once again in the midst of intense debates about state revenue, spending, and taxes. The recent upholding of Gov. Mike Dunleavy’s veto of SB113, a measure that would have expanded corporate income taxes on certain businesses, is a reminder of why we must be cautious about creating new taxes.

Supporters of SB113 pointed to education as the intended beneficiary. A quick reading of the Alaska Constitution shows why that claim is far from certain. Article VII states, “The proceeds of any state tax or license shall not be dedicated to any special purpose,” except in limited circumstances. In other words, even if a tax increase is sold as being “for education,” the legislature is under no constitutional obligation to spend that money on education at all. Upholding the veto not only protected Alaskans from hidden costs that would ultimately fall on families and consumers, it also prevented the legislature from gaining additional revenue that could be redirected elsewhere.

A corporation exists to make money for its shareholders. That is not greed, it is basic reality. Anything the government does to increase a company’s costs, whether through taxes, fees, or regulations, does not simply disappear. Those costs are passed on to consumers through higher prices for the goods and services we all rely on. This is basic economics.

When the state talks about taxing businesses, we need to be honest about who ultimately pays. Economics is not partisan, and it is not theoretical. It is how things work in the real world.

Direct taxes on sales, such as a sales tax or a value added tax, are the easiest to see. They are added at the register. A $100 item with a 10 percent sales tax costs the buyer $110. The consumer pays the full amount. There is no mystery and no business quietly absorbing the cost.

Taxes on producers or suppliers work the same way, just less visibly. Corporate income taxes, excise taxes, and import tariffs all raise the cost of producing or delivering goods. To remain viable, businesses must pass those additional costs along through higher prices. Ultimately, they have no choice, pass on the costs or go out of business.

The mechanics are straightforward. Prices are determined by supply and demand. When a tax makes it more expensive to produce or sell something, less of it is offered at existing prices. Prices rise, and overall consumption falls. Consumers end up paying more.

This hits hardest for things Alaskans cannot easily do without, such as fuel, heating oil, groceries, and pharmaceuticals. For many rural communities, essential goods and medications must be ordered online and shipped long distances. When costs increase anywhere along that supply chain, families in villages feel it first and most sharply.

Excise taxes on cigarettes and alcohol are routinely passed directly to consumers, often more than dollar for dollar. Studies of the 2018 and 2019 federal tariffs showed that American consumers paid most of the cost through higher retail prices. Corporate income taxes follow the same pattern.

Research after the 2017 federal tax reforms found that roughly 20 to 50 percent or more of corporate taxes are passed on to consumers in higher prices, with the remainder showing up as lower wages for workers or reduced returns for investors.

The idea that a corporate income tax does not cost consumers a single dime is simply incorrect. The costs are real, and they show up in everyday prices. This is not politics, it is economics.

There are limited exceptions. In highly competitive markets where customers can easily switch providers, businesses may absorb some costs in the short term to avoid losing sales. Subsidies or targeted tax credits can also reduce the immediate impact. But these situations are the exception, not the rule.

No tax exists in a vacuum. Every tax imposed on goods or services has real consequences. Those costs always land on people, whether through higher prices at the store, lower wages for workers, or smaller returns on retirement savings.

In the real world, taxes on businesses reliably mean higher prices for Alaskans. Saying otherwise does not change the facts.

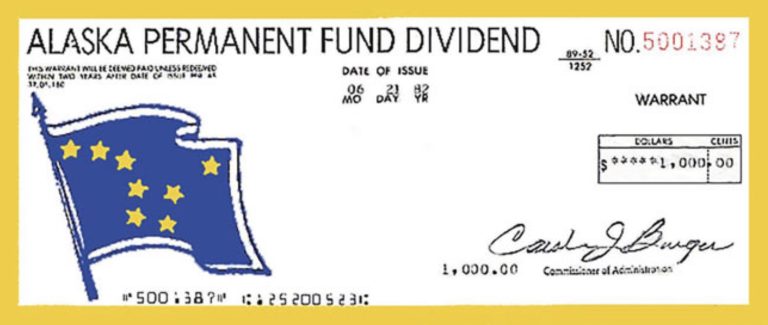

As budget discussions continue in Juneau, I urge my colleagues and fellow Alaskans to keep this reality in mind. Upholding the governor’s veto of SB113 was the right decision as it had no corresponding spending limit or PFD language.

We should focus on growing our economy, attracting investment, and keeping costs down for Alaska families. We should not be layering on new taxes without spending controls and meaningful cuts. That strategy will only make life more expensive for Alaskans as the legislature continues on their spending spree.

Rep. Kevin McCabe is an Alaska legislator representing District 30, Big Lake. He has lived in Alaska for 43 years, served in the US Coast Guard, as a Boeing 747 captain, and was a volunteer firefighter.

5 thoughts on “Kevin McCabe: Who really pays when Alaska taxes businesses?”

Claman never met a tax he didn’t like. In fact, every Democrat jumps with glee whenever the word “tax” is mentioned.

Wielechowski is exactly the same.he’s only happy when he is picking the public pockets

A very unfortunate truth.

Many Republicans are not far behind them, however!

if you get something in exchange for paying money, I say the money belongs to the business or service. At least that’s the way that seems to be the way it works for me. I go to the grocery and choose anything I want. Then I go to checkout and give them all the money they want!

Hmmm(???) … What state tax do the Native Corp 8(a) companies pay? Or, are they a ‘tax-free’ entity?