By SUZANNE DOWNING

Gov. Mike Dunleavy’s operating budget proposal, now being presented to Finance committees in the Alaska Legislature, outlines a spending plan that prioritizes a full statutory Permanent Fund Dividend, energy development, disaster response readiness, transportation maintenance, education funding, and long-term infrastructure investment across state agencies.

The proposal reflects a mix of general fund spending, federal receipts, designated funds, and supplemental appropriations, with major emphasis on resource development, public safety, and foundational state services.

At the statewide level, the budget proposes $2.3 billion in unrestricted general funds (UGF) to fund a full statutory Permanent Fund Dividend, estimated at approximately $3,650 per eligible Alaskan. The likelihood of this passing through the Legislature is nil. In fact, the dividend may be ratcheted down to the lowest level in years.

In addition, the governor proposes $1.4 billion UGF for Permanent Fund inflation proofing, transferring funds from the Earnings Reserve Account into the Permanent Fund principal.

The budget also includes $129.6 million UGF for recapitalization of the Alaska Higher Education Investment Fund from the Constitutional Budget Reserve Fund as a FY2026 supplemental item.

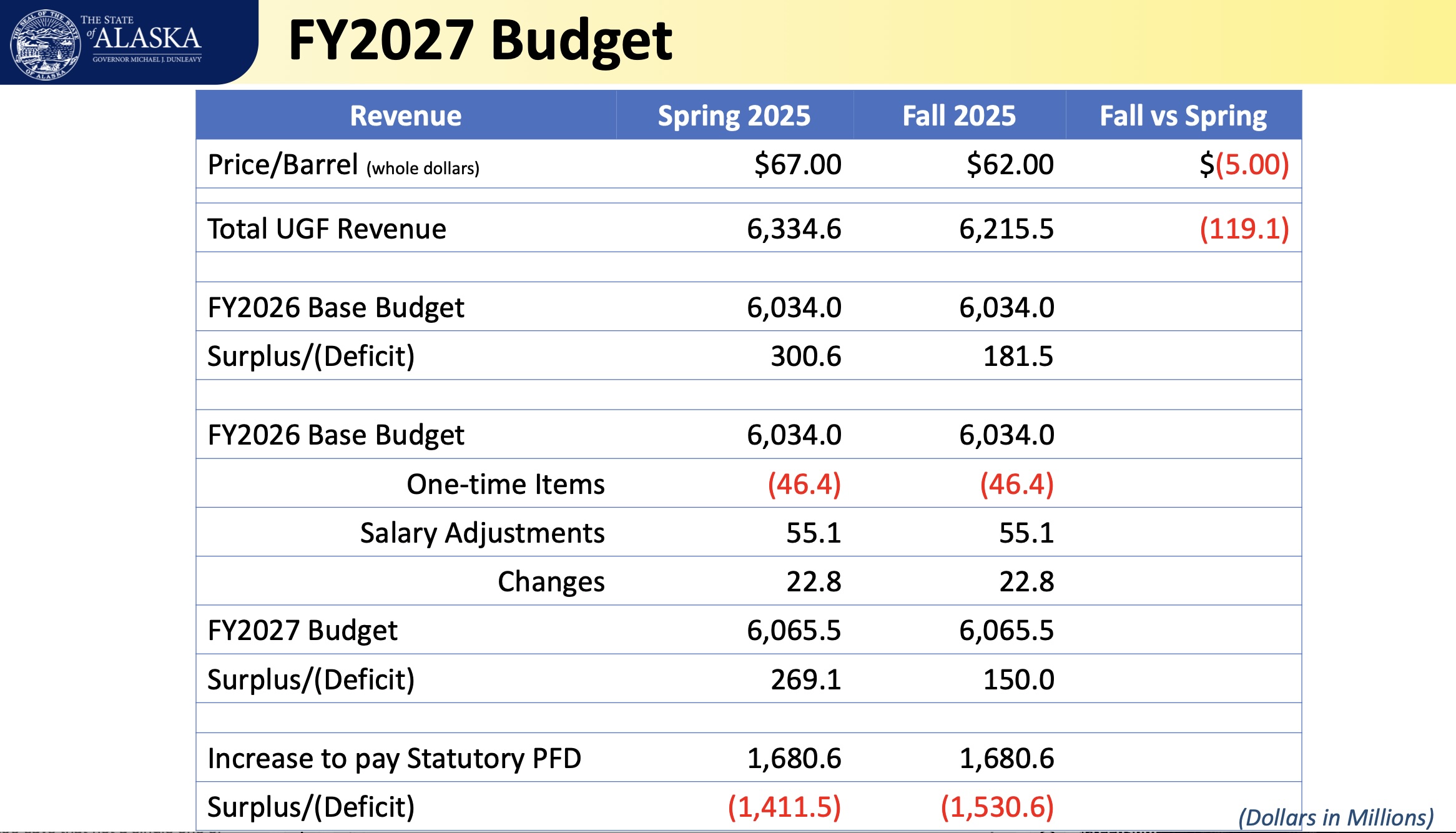

Revenue assumptions are based on a projected oil price of $68 per barrel, with total UGF revenue estimated at $5.98 billion, compared to a FY2026 base budget plus supplementals of $6.33 billion, resulting in a projected deficit position when supplementals are included.

Energy development remains a central focus of the proposal. The Department of Commerce, Community, and Economic Development includes:

-

$2.24 million UGF for the Alaska Gasline Development Corporation to support operational funding tied to Alaska Liquefied Natural Gas (AK LNG) development.

-

$44.3 million from the Power Cost Equalization Endowment Fund for the Power Cost Equalization Program, administered by the Alaska Energy Authority. This helps energy costs in rural Alaska.

Additional energy infrastructure funding includes $15.3 million in Ocean Ranger receipts for cruise ship terminal port electrification, also directed to the Alaska Energy Authority.

The Department of Education and Early Development budget includes:

-

Full statutory formula funding for the Foundation Program and pupil transportation.

-

$3.29 million for projected increases in Alaska Performance Scholarship awards.

-

$1.65 million for increased Alaska Education Grant awards.

The operating budget also includes continued investments in workforce and training systems, including law enforcement certification support and worker compensation system stabilization funding.

Disaster preparedness and emergency response receive major funding increases:

-

Disaster Relief Fund deposits:

-

FY2026: $40 million UGF (supplemental)

-

FY2027: $33 million total ($24M UGF, $9M federal)

-

-

Fire Suppression Fund deposits:

-

FY2026: $55 million UGF

-

FY2027: $73.48 million total ($47.48M UGF, $5.5M other, $20.5M federal)

-

Public safety funding includes:

-

$1.3 million UGF to maintain body-worn and in-car camera systems

-

Expansion of law enforcement and Village Public Safety Officer training and certification

The Department of Transportation and Public Facilities budget restores funding reduced in prior legislative actions, including:

-

$5.25 million UGF to restore highway and aviation maintenance funding

-

$1.25 million UGF to replace one-time Alaska Housing Capital Corporation funding

-

Statewide transportation match funding totaling more than $200 million to leverage federal infrastructure dollars

-

$27.5 million for Alaska Marine Highway System vessel overhauls, certification, and facility rehabilitation

-

Statewide deferred maintenance and repair funding

Natural resource development receives expanded operational support, including:

-

Continued funding for critical minerals mapping under the Earth MRI Program

-

Support for National Historic Preservation Fund operations

-

Forestry and fire programs

-

Timber inventory initiatives in the Susitna and Tanana Valleys

-

Land and Water Conservation Fund grant programs

Housing and rural infrastructure has significant federal and matching funds:

-

$92.9 million for Alaska Housing Finance Corporation annual housing programs

-

$272.5 million for Village Safe Water and Wastewater Infrastructure Projects

-

$50.9 million for Clean Water and Drinking Water grants, including IIJA and WIIN Act funding

Health funding priorities include:

-

Full statutory funding for the Senior Benefit Payment Program

-

Federal funding for public health, substance misuse prevention, and behavioral health crisis response

-

Funding for mental health trust housing modifications to support aging in place

The Dunleavy administration is presenting a budget balanced between core services, long-term infrastructure investment, economic development, and dividend protection, while relying heavily on federal receipts and supplemental funding to stabilize disaster response, transportation, and public safety systems.

More details can be found at this link.

The proposal now moves into the legislative budget process, where lawmakers will review, amend, and negotiate final appropriations during the 2026 session.

2 thoughts on “Breaking down the budget: PFD, Education, Energy, and not enough revenue for it all”

They’re going to steal theDividend again. Because They Know Better than those garbage Deplorablesof the general public how the money should be spent! . They’re so very much ” smarter” and ” better” than us their buddies deserve the money way more than the mere Alaskan public

1st Choice: Significantly reduce the size of government (includes overcoming apathetic voting patterns and installing new elected officials at all levels), 2nd Choice: Significantly allow for growth in the natural resources industry, 3rd Choice: Solicit large donations from those who approve of bloated government. THEY can use THEIR money to push THEIR agendas, 4th Choice: Since the first two will likely be ignored by “our representatives”, reduce PFD and return subsurface rights to landowners. 5th Choice: Sales Tax. IF the State cannot control its spending or improve the economy, then PFD should be first source of income. It doesn’t require setting up a new bureaucracy, create new exceptions for those with well-paid lobbyist, punish productivity, or give us a new filing headache to deal with. In fact, it might even discourage some of those inclined to seek public assistance to live elsewhere. The only advantage to a sales tax is that everybody can better see what is happening to their dollars and personally feel the pinch. Most just don’t realize how much PFD they’re losing on an annual basis. However, it creates new bureaucracy and burden for business. Income tax is least palatable for someone who gets up and goes to work on a regular basis.