As Anchorage residents debate a proposed 3% sales tax increase that will probably be placed on the April ballot, the Anchorage Assembly is set to take up a separate, additional sales tax proposal during its regular meeting Tuesday evening.

On the agenda under Unfinished Business, Assembly members will resume action on Ordinance AO 2025-96, which would place a 1% sales tax on the ballot to fund the so-called “Penny for Progress” Strategic Investment Program. The meeting begins at 5 pm Tuesday.

The ordinance has already gone through a public hearing process, which was closed earlier this year, but Assembly action has been postponed three times – on September 9, October 21, and November 18. Tuesday’s meeting is scheduled to bring the proposal back for debate and potential action.

If approved by the Assembly, the measure would not immediately impose the tax, but would instead submit the question to Anchorage voters through a charter amendment. The proposal would authorize a 1% municipal sales tax dedicated to capital and infrastructure projects identified by the Assembly under the “Penny for Progress” program.

A substitute version of the ordinance, AO 2025-96(S), includes certain exemptions and is also listed on the agenda. Supporting documents include Assembly and Information Memorandums, as well as a Summary of Economic Effects prepared for Assembly members.

The timing of the item is notable, as it comes alongside broader discussions about a separate 3% sales tax proposal, raising concerns among some residents about the cumulative tax burden facing Anchorage households and businesses.

While Assembly members have framed the 1% tax as a targeted investment tool, critics argue that multiple sales tax proposals—considered separately—could combine to significantly increase the cost of living in a city already struggling with affordability.

In addition to the 1% “Penny for Progress” sales tax, the Anchorage Assembly is also scheduled to revisit another tax proposal under Unfinished Business on Tuesday’s agenda.

Ordinance AO 2025-117 would place before voters a charter amendment authorizing a 2% tax to fund public infrastructure and capital improvements tied to housing construction, as well as cultural and recreation facilities. The ordinance is sponsored by Assembly Vice-Chair Brawley.

As with the other tax measures, the public hearing on AO 2025-117 has already been held, but final Assembly action has been postponed multiple times – on October 21 and November 18 – and is now slated for renewed consideration.

A substitute version of the ordinance, AO 2025-117(S), narrows the proposal to a 2% room rental tax, rather than a broad-based tax, while maintaining the same stated funding goals. Supporting materials for the item include Assembly Memorandums and a

If approved by the Assembly, the measure would go to voters and would require passage by a simple majority—50% plus one—of those voting on the question.

Taken together, the return of multiple tax proposals to the Assembly agenda shows the insatiable appetite of Anchorage government for more money from citizens.

Short-term rental tax also up for Assembly action

The Anchorage Assembly agenda also includes a fourth tax proposal, this one aimed specifically at short-term rentals.

Ordinance AO 2025-97 would submit to voters a charter amendment authorizing the Municipality of Anchorage to impose a tax on short-term rental properties, such as those listed on platforms like Airbnb and Vrbo. The ordinance is sponsored by Assembly Member Daniel Volland and Assembly Chair Chris Constant.

As with the other tax measures on the agenda, the ordinance does not immediately impose the tax but would seek voter authorization through a charter amendment. If approved by the Assembly, the proposal would appear on a future municipal ballot for voter consideration.

The stated rationale for the measure centers on generating additional municipal revenue from short-term lodging activity, which Assembly supporters have linked to broader housing and infrastructure discussions. Additional taxes on short-term rentals could be passed along to visitors or discourage property owners from participating in Anchorage’s tourism economy.

The inclusion of the short-term rental tax alongside multiple other proposed tax measures has added to growing public scrutiny over how many new or expanded taxes Anchorage voters may be asked to consider in a single election cycle.

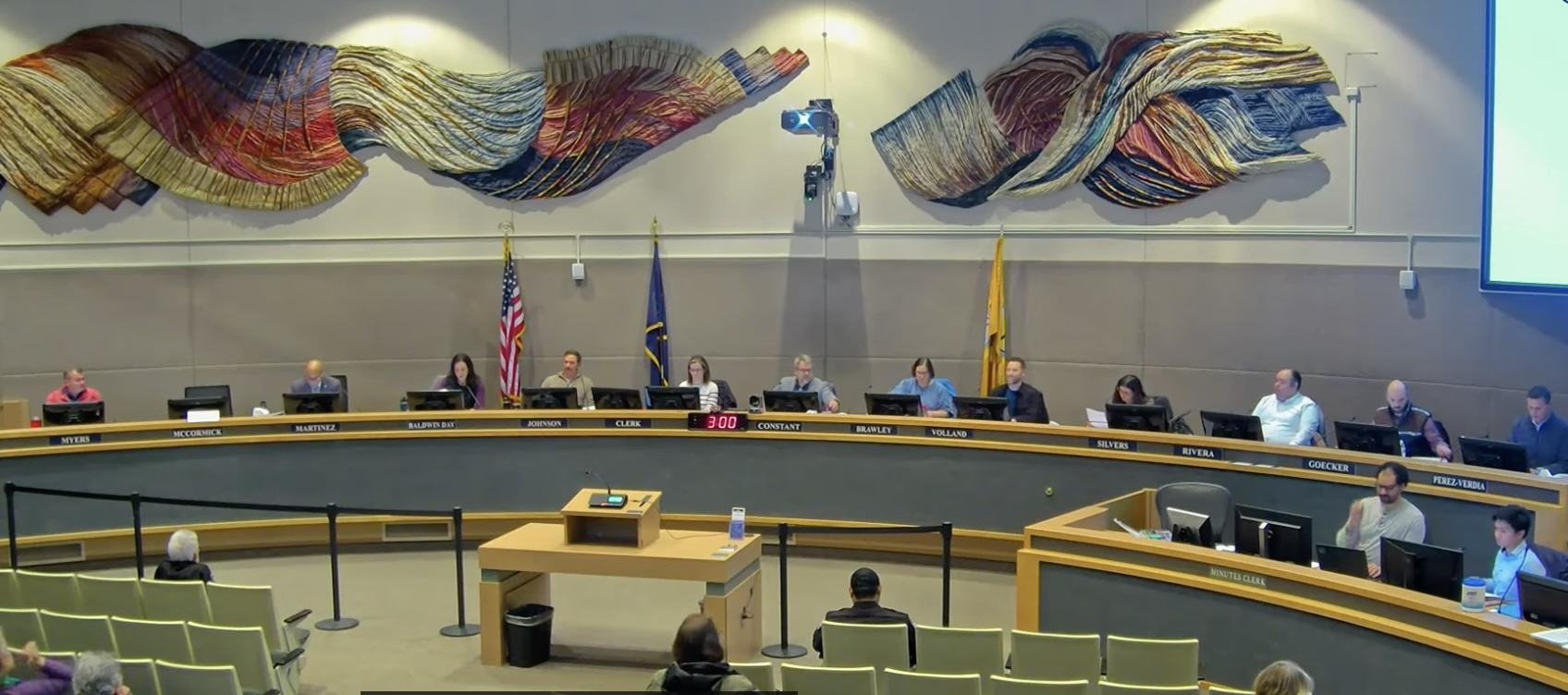

The Anchorage Assembly meeting will be held at the Z.J. Loussac Library Assembly Chambers.

3 thoughts on “Anchorage Assembly to take up second, third, and fourth tax proposals on Tuesday”

Has anyone found out what happened to the alcohol tax money? Seems to have vanished. Not sure any more taxes will fare any better with this batch of Assembly grifters led by the grifting head honcho.

How much of a 1% sales tax is taken up in the collection and administration of said tax?

Don’t worry: They’ll add 0.25% to help pay for this 1% along with all the other pennies and nickels they’re grifting. A tax to pay for the cost of taxation. I’m not leaving L.A. soon enough!