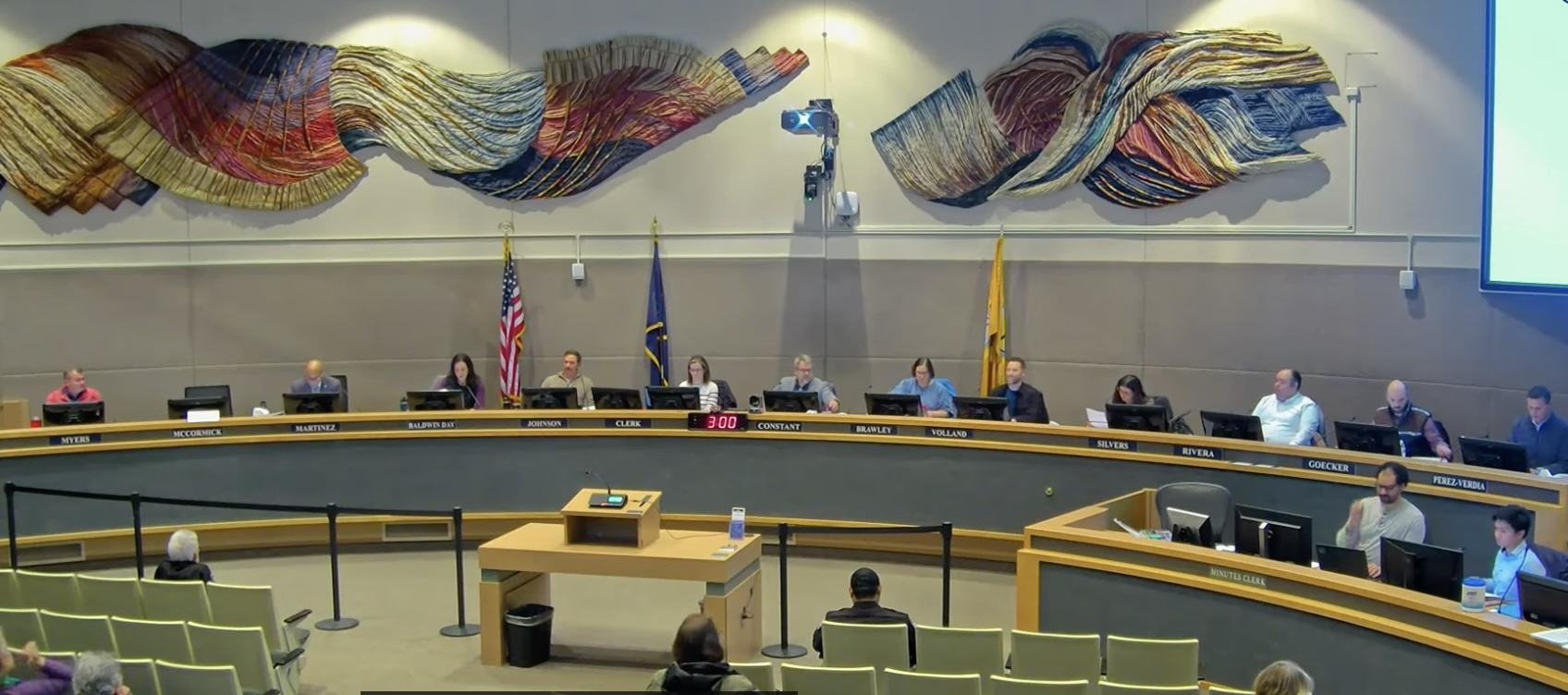

The Anchorage Assembly on Tuesday night introduced the mayor’s new proposal to place a 3% sales and use tax before voters on the April 2026 municipal ballot, a measure that would radically reshape how the city funds government and dramatically expand municipal revenue.

Public testimony will open on Dec. 2, with Assembly leadership already signaling that the hearing will be continued to Dec. 16, a two-week span that runs straight into the holiday season. The Assembly must finalize ballot language by mid-January, meaning a vote could come either on Dec. 16 or at its first meeting of 2026.

The timing alone raises eyebrows. Trying to rush a major tax overhaul through while the public is Christmas shopping has become something of an Assembly hallmark.

Anchorage’s biggest tax grab in decades: City Hall wants 3% more from your wallet

If approved by voters, the measure would authorize a 3% sales tax beginning in, 2028, with an estimated $165 million in revenue during its first full year of collection.

One-third of the tax (1%) would supposedly be earmarked for each of the following:

-

Property-tax relief

-

Public safety and infrastructure

-

Housing and childcare subsidies

The proponents say it will “diversify revenue” and “reduce the burden on homeowners.” But this sales tax comes mere days after the Assembly passed the largest operating budget in Anchorage history.

The proposal devotes one-third of the revenue, a projected $53 million in 2030, to reducing property taxes. That sounds generous on paper but Anchorage taxpayers have seen this movie before: “new revenue now” is often followed by “new spending later,” and the relief never quite materializes the way it was sold. Think: Alcohol tax.

The Assembly’s own memo acknowledges that the city would spend $6.5 million just to prepare for tax collection and another $4.8 million annually to administer the tax costs that include:

-

28 new municipal employees

-

A newly expanded Treasury Division (nearly doubling in size)

-

Custom software with no current cost estimate

-

Potential need for new office space

Anchorage has never administered a broad sales tax. The municipality would effectively be building a new tax bureaucracy from scratch.

Officials claim that one-third of the total revenue would come from non-residents, such as tourists and commuters. But buried in the economic analysis is a notable detail: of the estimated 2029 revenue:

-

$106 million would be paid by Anchorage residents

-

$59 million would be paid by non-residents

That’s 64% local / 36% non-local, meaning Anchorage households and businesses would shoulder the majority of the tax.

Tourism-derived revenue is estimated at only $57 million, and commuter impact is negligible at $2 million, further undercutting the talking point that “outsiders will pay for a big chunk of it.”

A sales tax is “inherently volatile.” A downturn similar to 2020 would drop expected 2029 revenue from $148–$176 million down to $128 million. That would have major consequences for city budgeting, especially after Anchorage expands its government to administer the new tax.

Supporters cite national comparisons claiming Anchorage has one of the lowest combined tax burdens among major cities. But those same comparisons show Anchorage’s property taxes rank in the top 10% of counties nationwide.

In other words: yes, total taxes are low, but only because Anchorage doesn’t have a sales tax.

And while the sales tax revenue would theoretically reduce property taxes, nothing in the ordinance prevents a future Assembly from continuing to raise the budget, and raise the sales tax, canceling out the relief.

Anchorage homeowners have seen that playbook, too.

If approved, this would be the largest tax policy shift in municipal history. And it comes just as the Assembly increases spending to historic levels, builds out new government structures, and assures the public that they will get “free stuff,” “more services,” and “lower property taxes” all at once.

Public testimony begins Dec. 2, may continue Dec. 16, and a vote may be delayed until early January. If the Assembly pushes it forward, as they almost certainly will, the final decision will ultimately rest with voters in April.

Jared Goecker: Anchorage has a spending problem, not a revenue problem

13 thoughts on “Anchorage Assembly introduces the 3% sales tax; testimony ahead”

Still waiting on that billion dollar payment from the sale of ML&P that was supposed to go towards tax relief and infrastructure…..!

I am noticing the time stamp on your post ….post dated or you are half way around the world. 😊

With that said though it is mind boggling that we have seen nothing about that. What was it used for and where did it go?

Elizabeth, please note your comment is also “posted ” at an “early hour”. I have noticed that many posts are “middle of the night” time stamped, which makes me wonder where the server is housed.

Watching the assembly I sometimes wish I were “half a world away” 🙂

Or……Suzanne is a night owl, who never sleeps and she moderates and posts comments when she can and that is the date and time stamp that appears on the blog.

Thank you Suzanne, we appreciate you so very much!!

It is time to ask all the Assembly members where all the millions of federal Covid relief dollars were pissed away on in a sh*t house rush right before Bronson was sworn in?

It was so far outside the parameters they are just lucky the feds didnt demand repayment but old Joe was too far downstream to even know what year it was.

No matter how much a government dependent taxes. whatever is collected will Never be enough for the government dependent.

Isn’t earmarking revenue not allowed under the law? Or is that just at the State level?

It’s doubtful we’ll get ANY relief from this scheme but something tells me if the Assembly thinks the homeowners ARE getting some relief they six ways from Sunday to retaliate.

…they *have six ways from Sunday to retaliate.

Can you imagine how much the Left Marxists on the assembly would spend on homeless, welfare, Climate Change, DEI initiatives (LGBTQ, “equitable” housing, pork for the poor) and their endless Portland wish list of Dem transformation across the city?

They want nothing less than complete control of power & the dismantling of Capitalism.

The lust of power-hungry radical leftists for both power, and for the wealth of their fellow citizens, knows no bounds.

.

The sooner that Eaglexit happens, the sooner we can be rid of these insane and destructive radical leftists in Anchorage — both the assembly sociopaths, and the gullible citiots who vote for them.

You know they will eventually raise both the sales & property taxes. I would only support a sales tax if we abolish property taxes simultaneously.

Uh, you pay no State income tax and you get thousands in free money every year from the State. Quit your b*tching.