By SEN. ROBERT MYERS

Feb. 9, 2026 – In 1999, a special election with nearly 42% turnout (almost as high as the 2022 general election turnout), 83% of Alaskans voted to advise against cutting the Permanent Fund dividend to fund government. Since then, polls in the last decade generally show public support for paying the statutory dividend in the 60% to 70% range. It usually ranks among the least popular options for paying for government. Yet, it continues to happen. Why?

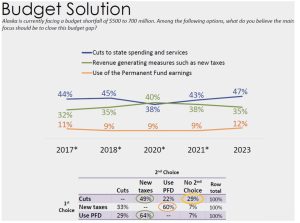

A poll commissioned by the Alaska Chamber of Commerce and conducted by Dittman Research in 2023 sheds a lot of light on the matter. Instead of asking which was the best option for fixing the state budget, they asked what the second-best option would be if the first option didn’t work. The results are striking.

Here are the takeaways that I have from these results. First, I see largely two groups of people. One group’s primary goal is to preserve state spending. That should be no surprise after all of the time I’ve spent talking about why the push for state spending is so high. But it explains why the second choice of “new taxes” is “use PFD” and visa versa. Spending cuts are avoided.

The second group is focused on cuts to state spending. Not only is it the largest of the three groups (but still not a majority) in 2023, but the most common second choice in this group is “new taxes” because they likely realize that if the goal is to cut government growth, or at least keep it down, new taxes are more likely to do that than spending the PFD. New taxes require an affirmative vote in the legislature and will likely create pushback on spending. We as voters can see who is in favor of more spending through the tax vote, and in a pinch, we can rein it in with a ballot measure. Using the PFD keeps spending hidden, lets legislators hide both the true cost of government and their true feelings on spending, and prevents any alterations from the ballot box.

The next thing I see is that nearly 3 out of 10 people who want to cut spending don’t have a second choice. We’ve already seen how likely spending cuts are to fly with the current structure. The governor tried to right the ship in 2019 and received a massive amount of pushback, including an attempted recall. Just last year, his budget veto was overridden. Significant spending cuts will likely face the same result if the structure and incentives haven’t changed. Instead, the group of people who want smaller government the most are also the most likely to take themselves out of the fight when the first strategy doesn’t work. Just like in ranked choice voting, a second or third-place choice that we don’t want can win if we don’t make use of all of the choices.

In addition to public opinion, there are other headwinds. We have roughly forty to fifty percent voter turnout in state elections. People on the upper end of the income scale (and more averse to taxes) are more likely to vote. Those same people are often also the ones more likely to benefit from state spending because of a state contract, which makes them less likely to want to cut the budget. From the outset, that weighs the choices in favor of continuing to spend and avoiding taxes at the outset, leaving the PFD to bear all of the pressure.

Finally, the PFD is the money that is already passing through state hands. If the goal is to keep spending up, using money that already passes through state channels is much easier to use than money that has to be collected from the public and the economy before the state can use it. Inertia is a huge force in state government. Overcoming that means dropping the easy choices on either the spending or revenue side.

I’ve been telling people for years now that the PFD is not the problem in our state’s finances but instead just the most visible part. Even after the PFD is gone, we will still have this debate over taxes and spending. But the true problem in this state is that the spending egged on by the twisted incentives created by our fiscal structure. Until we stop letting the state live off the easy money of oil and the Permanent Fund, we will still be in this mess regardless of how big the PFD is.

Senator Robert Myers was born in Fairbanks and spent much of his young childhood at the Salchaket Roadhouse, owned by his parents. He attended the University of Alaska Fairbanks, where he studied philosophy, political science, and history. While in college, he drove for a tour company, sharing Alaska with countless visitors. He currently drives truck and travels the Dalton Highway (Haul Road) frequently. He ran for office because he wants an Alaska his children will choose to make their home down the road. When not working for his Senate District B, North Pole, he enjoys reading, history, board games, and spending time with his wife Dawna and his five kids.

Sen. Robert Myers: Why do so many Republican legislators support higher spending?

Sen. Robert Myers: Why do we spend so much money but have such poor quality services?

7 thoughts on “Sen. Robert Myers: If the Permanent Fund dividend is so important, why do we keep cutting it?”

The answer is simple:

We Democrats want more Big Government spending, not less. A big PFD to resident Alaskans means more citizen sovereignty, something we Democrats hate with a passion. No more PFD….. period. Thank you for my service announcement. Now please, send me a big donation so I can straighten out the mess that you sober Republicans created. Then, I’ll have a big drink to that. Many, in fact. Cheers.

Another genius testimonial from our favorite inebriated journalist.

🤣

Why?? Because if its there,Democrats will steal it. Any available funds will be siphoned off to buy votes from favored groups. Or to fund lawyers filing against disfavored groups. Alternatively to those, they can be used to line personal pockets, once laundered through things like Learing Centers.

The title of the article is: “if the Permanent Fund dividend is so important, why do we keep cutting it?”

The answer is because the flow through the Trans Alaska Pipeline peaked in 1988 at 2 million barrels per day, and is only 1/4 of that today, due to natural decline.

There are some state expenditures that are more important than the PFD, such as courts, corrections, Troopers, road maintenance, snow removal, education, and infrastructure. The PFD should be trimmed before these essential services are trimmed.

But, there are some state expenditures that are less important than the PFD. These should be trimmed before the PFD is cut. All state expenditures (including the PFD) must fit within a balanced budget.

The article mentioned “spending cuts” numerous times, but did not state a specific possible spending cut. So I will.

#1 Trim Medicaid expenditures except for very needy cases. Encourage healthier practices, so people won’t put too much burden on Medicaid.

#2. Get rid of collective bargaining for state employees.

Unions are OK, as long as they are “benign unions”, meaning unions that use peaceful advocacy, rather than the pugnacious force of collective bargaining legislation.

Free-market bargaining is better that collective bargaining.

For instance if we need more corrections officers, the state should be able to easily increase the pay to attract them, and not run into a belligerent union that says, well, if you give more to correction officers, then you must give more to thousands of others, even though those others are adequately compensated.

Sure! dont cut the bloated education sewer. Keep throwing good money after bad, endlessly. Keep feeding the blob till it crowds out all other budget lines. The educocracy is never satisfied, so long as there is a cent they’re not getting

Chuck clarke. You are right. Any waste in any essential service should be trimmed out. This includes education. My solution for that, is to get rid of collective bargaining for public school teachers. But the core of an essential service, should not be cut to the bone, just for the sake of handing out more free money to citizens.

The article says “…the true problem in this state is that the spending is egged on by the twisted incentives created by our fiscal structure.”

What are the “twisted incentives”?

The article continues: “Until we stop letting the state live off the easy money of oil and the Permanent Fund, we will still be in this mess regardless of how big the PFD is.”

I see nothing “twisted” about oil taxes and the Permanent Fund. They are both blessings. They allow us to live here without having to pay a state sales tax or income tax.

They are both continuous fountains of free money for state services for us Alaskan people, plus for the PFD.

That is not a “mess”. That is wonderful. I’m grateful to God that he placed all that oil up on the North Slope eons ago.

I’m grateful to the companies and thousands of workers that have the skill and technology to extract it in the cold and blizzards.

The only way a “mess” can be created, is if the legislature imposes a state sales or income tax on us. That would not only suck our hard-earned money out of our pockets, it would also putrefy the honesty and purity of our dividend, by changing its source from honest surplus money, to income-redistribution money yanked from our pockets. It would morph our once proud dividend from a “PFD” into a “PAP” (Public Assistance Payment – welfare). This would warp the moral spirit of the Alaskan people. Our children would be raised twistedly, to think it is OK to grab money from other citizens, and stuff it into their pockets. We should want kids to grow up to be net producers, not leeches and bums.