By SUZANNE DOWNING

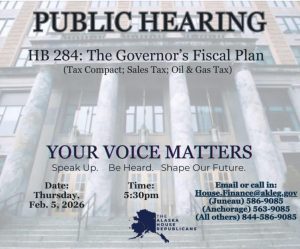

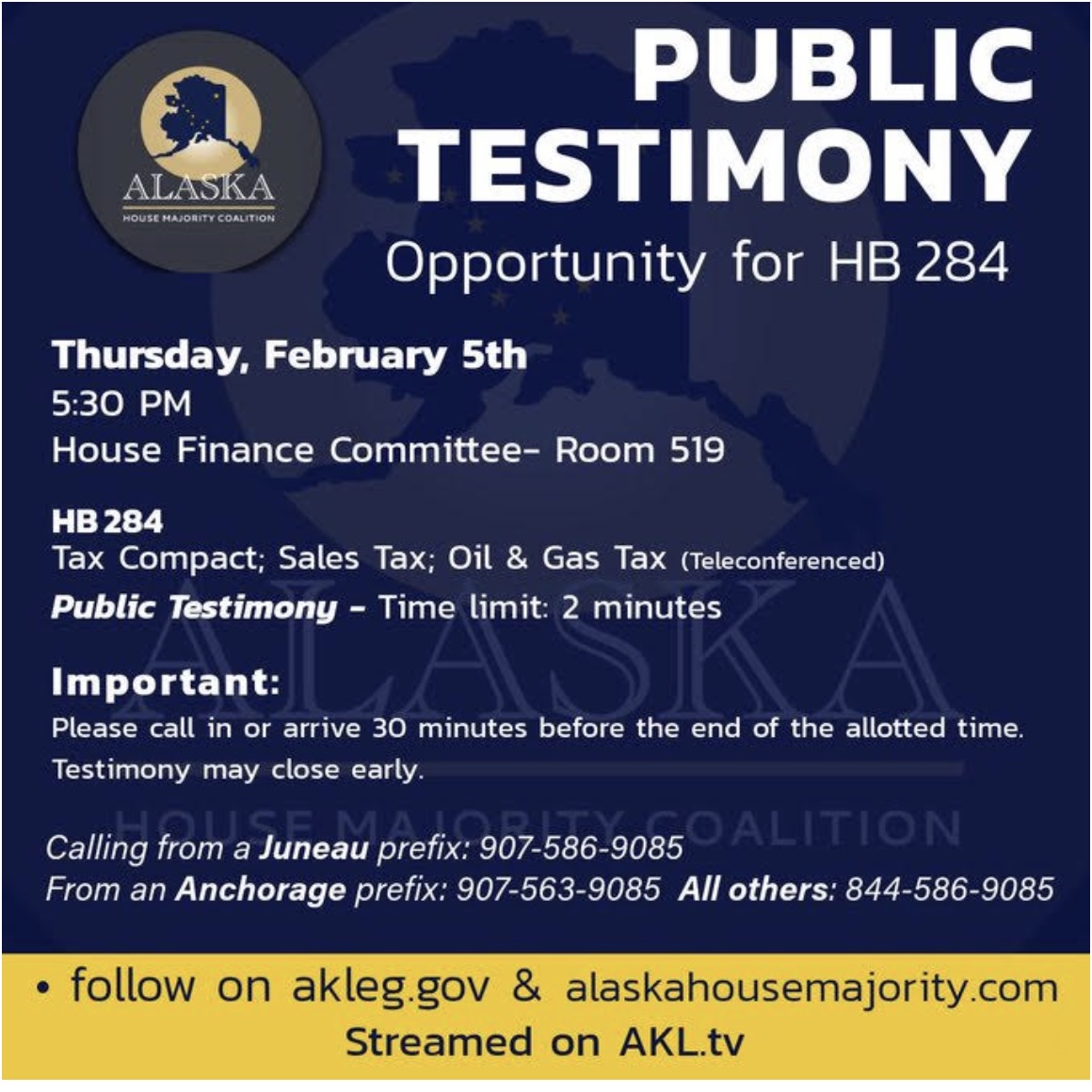

Feb. 5, 2026 – Alaskans will have a chance to weigh in today, Thursday, Feb. 5, during a legislative public hearing on Gov. Mike Dunleavy’s sweeping fiscal plan, House Bill 284, the broad package that touches everything from sales taxes to oil and tax taxes.

Ahead of the hearing, Rep. Kevin McCabe of Big Lake has offered his constituents a plain-English “Myth vs. Fact” breakdown of the governor’s overall fiscal plan, providing informed context from Legislative Finance and the state’s own fiscal modeling.

McCabe’s explanation from his newsletter is intended to help Alaskans sort through the competing claims surrounding the governor’s omnibus plan.

Permanent Fund: “Short answer: it protects it”

At the center of the debate is the Permanent Fund dividend, which McCabe argues would be strengthened under the governor’s plan.

The proposal includes a constitutional amendment guaranteeing that 50% of the Permanent Fund draw would go directly to Alaskans as dividends.

“That means the PFD would no longer be decided during annual budget negotiations,” McCabe’s handout notes, “but paid automatically under a clear, rules-based formula.”

Myth vs. Fact: PFD debate

One of the most prominent claims McCabe disputes is that the governor’s fiscal plan cuts or eliminates the dividend.

“The plan locks the PFD into the Constitution,” the document states, arguing that it would remove the yearly legislative fight over whether a dividend will be paid.

It also emphasizes that if voters approve such an amendment, lawmakers could not reduce or withhold the dividend without another statewide vote.

“This plan takes the PFD off the chopping block.”

Permanent Fund draw already funds government

McCabe also addresses concerns that the proposal would “raid” the Permanent Fund corpus.

He points out that Alaska already uses Permanent Fund earnings to support government operations. The difference, it argues, is that the governor’s plan would place clearer limits on the draw while guaranteeing that half goes to Alaskans first.

Fiscal modeling shows deficits shrink, but don’t disappear

McCabe does not claim the plan solves Alaska’s fiscal imbalance overnight.

In fact, he acknowledges that deficits remain, but argues they are smaller under the governor’s proposal, and that state savings would last longer.

“No credible analysis says the plan fails,” the document states, adding that Legislative Finance and independent analysts agree the plan extends Alaska’s fiscal runway.

Temporary taxes and spending discipline

The one-pager also addresses another politically sensitive part of the governor’s package: revenue.

The governor’s plan includes temporary, targeted measures such as a seasonal statewide sales tax and time-limited oil tax adjustments. Several provisions are designed to sunset in the early 2030s.

The plan also includes a statutory spending cap, which McCabe describes as helpful but not foolproof.

“It is not a magic switch that balances the budget overnight,” he cautions.

More specifics from the McCabe analysis:

Statewide sales tax & revenue changes (HB 284 / SB 227)

This legislation creates a temporary, seasonal statewide sales tax, set at 2% during the winter months and 4% during the summer tourism season, applied broadly to most retail purchases, including food and energy, with specific exemptions.

In addition to the sales tax, this bill:

- Raises the minimum oil production tax floor from 4% to 6% for a limited period

- Adds a 15-cent-per-barrel pipeline maintenance surcharge

- Transitions corporate tax rules and phases out the corporate income tax beginning in 2031

Together, these measures generate significant near-term revenue, but several provisions sunset later in the forecast, reducing long-term revenue unless extended.

Spending cap (HB 275 / SB 223)

This bill proposes limiting annual growth in the state’s operating budget to 1%. Important context:

- The cap is statutory, not constitutional

- It can be overridden by the Legislature

- It is intended to encourage fiscal discipline, not serve as an absolute spending limit

Permanent Fund dividend & Permanent Fund reform (HJR30/SJR23)

This proposal is a constitutional amendment that would permanently change how the Permanent Fund is used. It would:

- Limit Permanent Fund withdrawals to 5% of the fund’s average value

- Guarantee that 50% of that draw is paid directly to Alaskans as Permanent Fund Dividends

- Allow the remaining 50% to support state services

- Merge the Earnings Reserve into the Permanent Fund principal beginning in 2027

Under current projections, this formula-based approach would result in a predictable, high-value PFD, estimated at approximately $3,600–$3,800 per recipient, depending on market performance. Because it is a constitutional amendment, voter approval would be required at the 2026 general election. Key takeaway: This proposal would lock both the Permanent Fund draw and the PFD formula into the Alaska Constitution.

Other elements

Other elements of the Governor’s plan include increasing bonding authority for the Alaska Railroad to help replace aging infrastructure and support long-term economic development and freight capacity.

These proposals are currently under consideration by the legislature. Debate will focus on:

Fiscal impacts and policy questions

- The size and persistence of projected deficits

- The structure and necessity of the statewide sales tax

- The long-term sustainability and size of the Permanent Fund Dividend

Specific tax policy changes

- Raising the minimum oil production tax floor from 4% to 6% for a limited period

- Adding a 15-cent-per-barrel pipeline maintenance surcharge

- Changing corporate tax rules, including phasing out the corporate income tax beginning in 2031

An adult tone in a familiar fight

While Alaska’s fiscal debates often devolve into partisan talking points, McCabe’s document strikes a notably different tone — one that acknowledges tradeoffs and avoids pretending there is an easy fix.

“This plan isn’t a silver bullet, and it doesn’t pretend to be,” the bottom line reads.

In a Capitol environment where the PFD is often used as both shield and sword, McCabe’s “Myth vs. Fact” sheet stands out as an effort to elevate the conversation.

One thought on “Public testimony to be taken on governor’s fiscal plan: Get informed with Rep. Kevin McCabe”

Well, no at the center of this debate is the proposal of a sales tax. First, the claim by anyone that this tax would be “seasonal” is not just deceptive, it is an OUTRIGHT LIE. And what absolute idiot would ever believe that a state sales tax would be “temporary”. Sure. Right. it’s going to sunset in 2034, Right. I was at Freddy’s just the other day, and when I checked out I was thinking “this bill is awfully high, but, still, I wish there was some way I could add some money here for my state legislators…” Also, I was searching around on my electric bill, looking for a line that said “Add $xxx.00 for state legislature”. But everyone just keep focusing on THE PFD! Blah blah blah PFD hur dur dur. Look at that great big important PFD carrot! Oh, that minor tax thing? Yeah, no no reason to look at that….. Once we go over the top of that slippery slope, we all might just as well start voting hard left on literally everything. No reason not to just go ahead and crash this effing thing.