By SUZANNE DOWNING

The Alaska Industrial Development and Export Authority’s 2025 annual report delivered to the Legislature paints a confident picture of record earnings, a bigger return to the state treasury, and a credit-rating upgrade, which lowers borrowing costs as the authority leans into major resource and infrastructure bets.

AIDEA reported statutory net income of $67.4 million for fiscal year 2025 (ending June 30, 2025), calling it the strongest performance in the agency’s history.

The board declared a $17 million dividend to the state’s General Fund, pushing AIDEA’s cumulative dividends since 1997 to more than $512 million, according to the report and related agency announcements being presented in Juneau this week.

The annual report also points to a financial milestone outside the income statement: S&P Global Ratings assigned AIDEA an AA+ rating, the highest in its history, which will reduce borrowing costs and expand access to capital for projects it considers high-impact.

In the annual report narrative, AIDEA emphasizes a mix of traditional heavy-industry development and newer investment lanes:

-

Ketchikan Shipyard operator transition from Vigor to JAG Marine, a continuity move to preserve skilled maritime jobs and support Alaska Marine Highway maintenance needs.

-

Continued push on the West Susitna Access Project, including permitting steps and stakeholder engagement to support transformational infrastructure for the Mat-Su and resource development corridor.

-

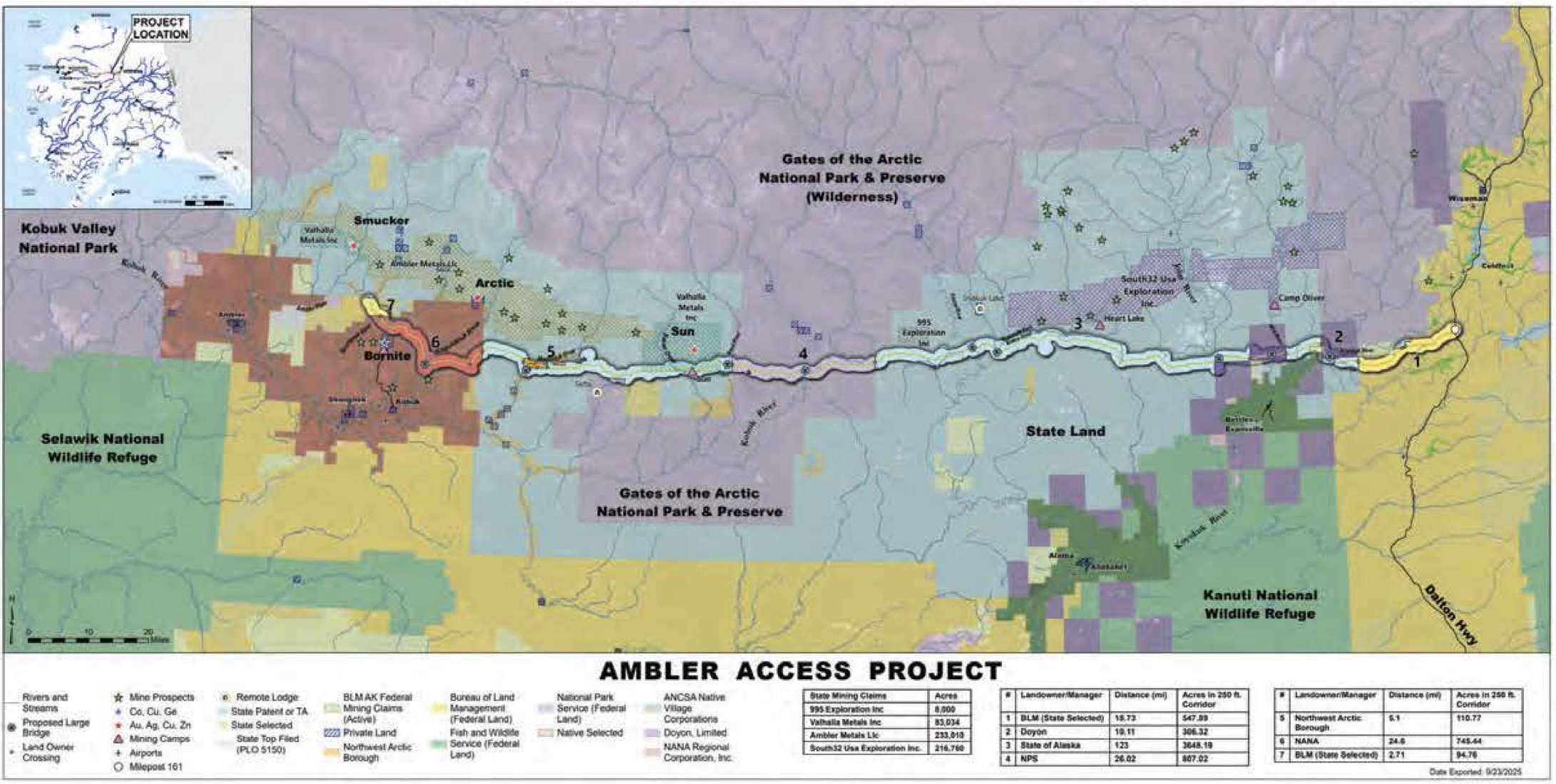

Ongoing work on the Ambler Access Project planning and coordination for a proposed 211-mile industrial road, tied to domestic mineral supply chains and national security.

-

AIDEA’s North Slope investment in Alyeschem, advancing a methanol and ultra-low sulfur diesel production facility intended to reduce imports and strengthen energy logistics.

-

Support tied to Cook Inlet gas, including AIDEA-backed financing activity around HEX Cook Inlet/Furie.

AIDEA also signals an intent to broaden its portfolio beyond legacy development finance, pointing to interest in data centers.

The report’s FY2025 financial section lists net position of about $1.56 billion, an increase of roughly $69.6 million year-over-year, supported by investment income and lease/interest revenues alongside operating income.

For lawmakers, the immediate takeaway is that AIDEA is arguing it has both the earnings momentum and borrowing credibility to keep playing offense. The strong balance sheet is allowing it to pursue big projects and send money back to the General Fund.